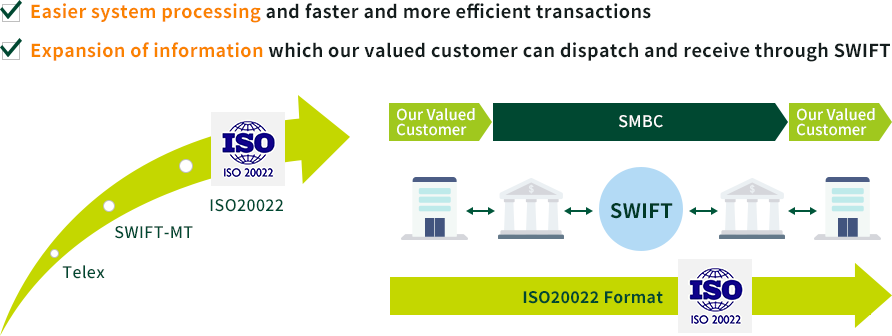

International Standardization of Foreign Remittance (ISO20022 Adoption and Migration)

- ・International remittance format (SWIFT : Society for Worldwide Interbank Financial Telecommunication), widely used by financial institutions all over the world, is required to be migrated to an international standard format (ISO 20022 format) by November 2025.

- ・Thus, we are planning to provide our valued customers with the new format specifications accordingly.

- ・For detail procedures, it will be provided through relationship managers, direct mail or e-banking announcements.

Regarding New Format

- ・The new format will comply with ISO20022 (the global standard for financial messaging) designated by International Standard of Organization.

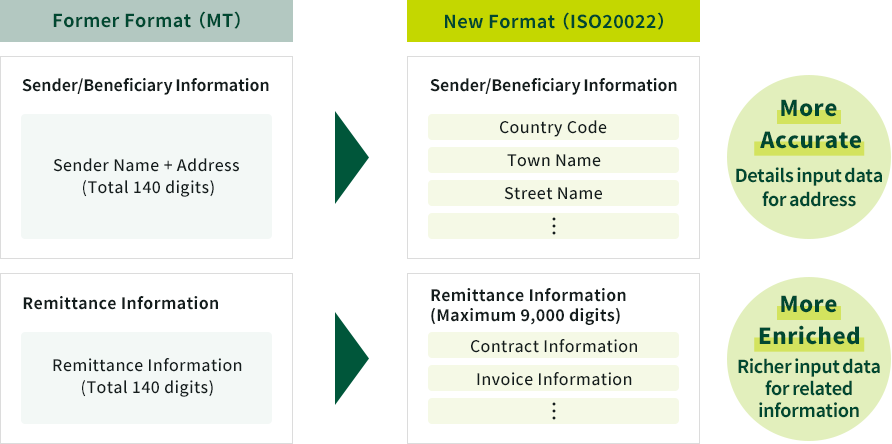

- ・The adoption of the new format is promoted globally as more enriched transaction information will be included in the new format than the former one.

- ・From perspective of Anti-Money Laundering enhancement, data input fields are increased and it becomes necessary to provide more details of Sender's/Beneficiary's address such as, including building name, street name, town name, state or country name.

Additionally, increased in input data (richer data) can strengthen operational efficiency. As an example, when remitting money for business transaction, including details of business transaction, such as Invoice number, ensures fast and smooth reconciliation task.

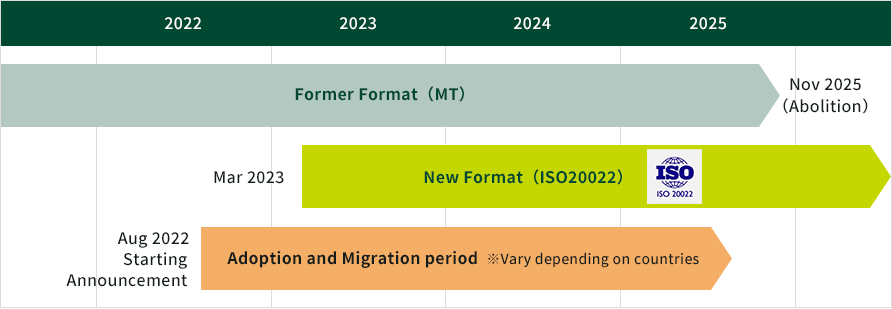

Schedule of Migration towards New Format

- ・Each financial institution is required to start migrating to new format from Mar 2023, and to be completely migrated to new format by Nov 2025.

- ・As the former format will be inaccessible from Nov 2025 onwards, we are currently preparing the entry interface for the new format.

- ・To our valued corporate customers, we will announce change in procedure of foreign remittance sequentially.

Impact on Inward Remittance

- ・Since Mar 2023, if the inward remittance comes in the new format, it is processed and deposited to customer accounts as usual.

- ・During coexistence of the new and former format, if the sender inputted data exceeds the word limit of the former format and if it is automatically converted to the new format, there is a possibility that all inputted data will not reflect properly and some data might be partially truncated. However, data conversion from the new format to former one will proceed in accordance with SWIFT designated rules, and thus the impact will be less and limited.

Impact on Outward Remittance

- ・For outward remittance, it is necessary to input remittance data in the new format. (including through what/where the remittance will be proceeded such as at branch, Global e-Trade Service, SMAR&TS, Firm Banking Service, E-Moneyger®, etc.)

- ・If the remittance is made through Global e-Trade service, SMAR&TS, E-Moneyger® or Firm Banking service, customers may need to upgrade their internal systems accordingly to be able to input data.

- Q.1.From when, will SMBC start migrating to the new format?

- A.1.From Mar 2023 onwards, adoption of ISO 20022 started sequentially.

For inward remittance, the new format started applicable since Mar 2023.

For outward remittance, the migration timing will be varied depending on the country. We will announce timely for further information. - Q.2.Besides SMBC, other financial institution will adopt ISO20022? Around when will start the migration?

- A.2.All financial institutions will deliberately migrate to the new format, as ISO20022 is the common standardized format for SWIFT Network users.

However, the migration timing will be varied depending on each financial institution. - Q.3.Is there any change in the remittance fees?

- A.3.No. There is no change in the remittance fees.

- Q.4.Around when does local settlement system migrate to ISO20022?

- A.4.Each regional local settlement system migration timing is as follows. (migration timing for e-banking users will be announced separately)

- ・US

CHIPS and Fedwire Funds Service will migrate in Nov 2023 and Nov 2025 respectively. – this may require customers to take certain actions to be ready. More information to come.

- ・EMEA

The European TARGET2 euro settlement system (TARGET2) will migrate in Mar 2023, – this may require customers to take certain actions to be ready. More information to come.

- ・ASIA

For Thailand, BAHTSNET was migrated in Aug 2022

For Singapore, MEPS+ will migrate in Apr~Jun 2024

For Hongkong, CHATS will migrate in Oct 2023

For Malaysia, RENTAS will migrate in Jul 2024

For Australia, new format will be available in RITS from Mar 2023. Until Mar 2023, current format and new format will coexist, and in Nov 2024, RITS will completely migrate to new format.

- ・US