Launch of SMBC Environment Assessment Loan (Malaysia), and AEON CREDIT SERVICE (M) BERHAD, the first company to utilize the new loan(1/1)

SUMITOMO MITSUI BANKING CORPORATION

Launch of SMBC Environment Assessment Loan (

December

17th, 2012 --- Sumitomo Mitsui Banking Corporation (gSMBCh, President: Takeshi

Kunibe) , announced today that Sumitomo Mitsui Banking Corporation Malaysia

Berhad (gSMBCMYh) and SMBC Labuan branch have launched SMBC Environment

Assessment Loan (Malaysia) designated for companies in Malaysia, to support

their environmental- friendly activities.

SMBC

Environment Assessment Loan (

In the

recent years, as the Malaysian government has been enhancing its environmental

administration, the environment-related business and market has been growing

rapidly. SMBC has been contributing to further enhance such development in

AEON CREDIT

SERVICE (M) BERHAD, subsidiary of AEON CREDIT SERVICE (CEO: Kazuhide Kamitani),

is the first company in

AEON CREDIT

SERVICE (M) BERHAD was evaluated as a company that is proactively implementing

environmental initiatives, based on its management system to mitigating and

reducing their environmental risks, in alignment with its corporate vision and

mission statement.

AEON CREDIT

SERVICE (M) BERHAD, a member of AEON group, a retail and financial service

company, is highly evaluated in terms of:;

1.

its

contribution to the society through a wide range of installment services and

small loans for small and medium-sized enterprise.

2.

its obtaining ISO 14001 certification and satisfying the conditions, and achieving the targets issued by this

certification in its reduction of paper usage by half with its on going

paperless activities and environmental conservation and reducing its overall

costs.

3.

its continuously carrying out various efforts in its

environmental-related activities including tree-planting program and its

managementfs promotion to their employees in developing a better understanding

of the environment.

Through providing this new SMBC Environment

Assessment Loan (

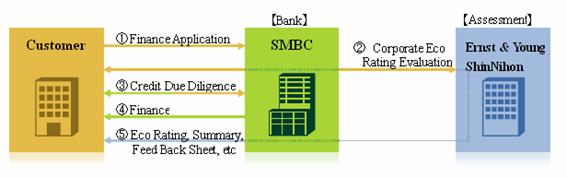

(Appendix)

Overview

of SMBC Environment Assessment Loan (

|

|

SMBC

Environment Assessment Loan ( |

SMBC Environment Assessment Loan |

||

|

General description |

Loan

product offered reflecting an evaluation of customerfs environmental

management system ( |

Loan product

offered reflecting an evaluation of customerfs Since the product

was launched in October 2008 till November 2012, a total of 140 contracts

equivalent to JPY 400 billion has been achieved. |

||

|

Commencement date |

December

2012 |

October 2008 |

||

|

Target

company |

Companies

who possess ISO 14001 or an equivalent environment management system

certificate, and satisfying certain SMBCfs internal standards. |

|||

|

Assessment

company |

Ernst

& Young ShinNihon LLC |

The Japan Research Institute, Limited |

||

|

Amount |

USD

10Mil equivalent (no currency restriction) or more |

Min JPY 100Mil |

||

|

Type of loan |

Loan on

notes and loan on certificate |

Loan

(on notes and on certificate), Private placement bond |

||

|

Tenor |

More

than 1 year and within 10 years |

Loan:

more than 1year, Private

placement bond: more than 2 years |

||

|

Interest rate |

Determined

interest by SMBC (taking into account the |

|||

|

Commission fee (Contract only) |

Min USD

10thousand (including tax) |

Loan: JPY 630 thousand (including tax) Private placement bond: described above +

commission fee |

||

|

Rating Result |

Platinum{ |

Leading the industry with environment

& sustainability (E&S) initiatives derived from evaluated

E&S opportunities/risks, in alignment to the corporate vision/mission

statement |

``` |

Implementing extremely excellent

environmental-friendly business management. |

|

Platinum |

Proactively

implementing E&S initiatives derived from evaluated E&S opportunities

/risks, in alignment to the corporate vision/mission statement |

`` |

Implementing excellent

environmental-friendly business management. |

|

|

Gold{ |

Proactively

implementing E&S initiatives based on company-wide environmental

management and a basic understanding of E&S issues in relation to its

business. |

` |

Implementing good environmentally friendly business

management. |

|

|

Gold |

Reasonable

E&S initiatives are in place, based on company-wide environmental

management and a basic understanding of E&S issues in relation to its

business. |

a |

Implementing a certain level of

environmental-friendly business management. |

|

|

Silver{ |

Necessary

E&S initiatives are in place, based on limited environmental management

and an understanding of the major E&S issues. |

b |

Implementing minimal

environmentally-friendly business management. |

|

|

Silver |

Ad-hoc

E&S initiatives are in place based on limited environmental management

and an understanding of the major E&S issues. |

c |

Implementing inadequate

environmentally-friendly business management. |

|

|

Bronze{ |

Ad-hoc

E&S initiatives are implemented based on limited environmental

management. |

d |

Not implementing environmentally-friendly

business management. |

|

|

Bronze |

Ad-hoc

E&S initiatives are implemented, with plans to establish an environmental

management system soon. |

¦ The

evaluation of SMBC

Environment Assessment Loan - Malaysia- and SMBC Environment Assessment Loan

are presented in the same column, it does not mean they are both in the same

level of evaluation. |

||

|

Certified |

Limited

E&S initiatives are implemented without an environmental management |

|||

|

n/s |

E&S

initiatives are not implemented. |

|||

(Scheme)

SMBC

Environment Assessment Loan (

}[VAÅÌt[ðfڵĺ³¢B