The emergence of storage

Before we examine the risk allocation strategies and the structuring approaches taken by the market on storage projects, it is worth understanding where the Australian market is coming from because it is this evolution that is going to drive risk management approaches in the years to come. What we have observed in the last 10 years or so is a shift in the generation mix, with wind and solar becoming a crucial contributor to the Australian power sector. With this success, a series of realisations started to emerge in the consciousness of local and international decision-makers, in particular within the project finance community – both equity and debt:

- 1The Australian grid is weak, marginal loss factor risk is not benign in Australia, and synchronous technologies will be less and less prevalent. The grid will need to protect itself from the onslaught of intermittent generators that is required by decarbonisation targets.

- 2Construction risk allocation and grid connection risk allocation are two very different topics.

- 3With a first in class household adoption of rooftop solar, and the very slow pace with which aging baseload coal-fired power plants are being mothballed in Australia, negative pricing and economic curtailment are now a key risk for large-scale renewables projects in Australia, in particular large-scale solar, with a wave of co-located AC and DC-coupled solar and Battery Energy Storage System (BESS) projects currently emerging in all states across Australia.

Australia being the sophisticated electricity market that it has been for decades, the emergence of these risks has triggered a rapid response from the private sector, the regulators and the politicians, with a view to:

- 1Create a stronger grid, with fiscal intervention to support the construction of transmission lines if need be, and this is culminating right now with the various renewable energy zones and the new transmission lines being built across Australia.

- 2Connect more renewables more efficiently, with more regulatory support than in the past, with the Australian Energy Market Operator (AEMO) having to beef up its teams to accelerate the connection of new renewables generation to the grid.

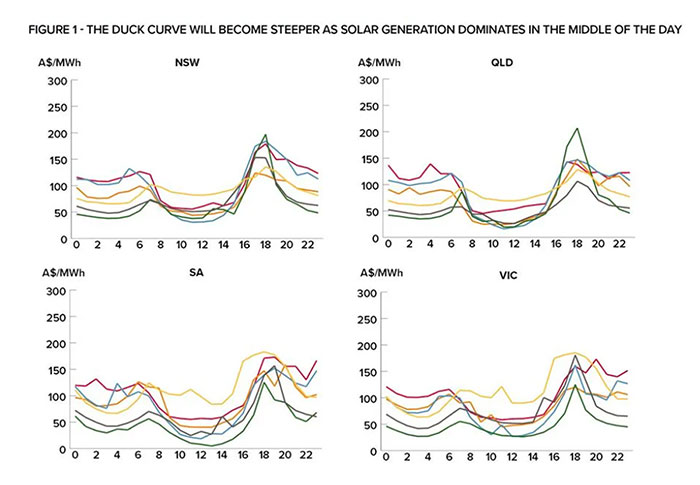

- 3Adapt the country to the new supply and demand profile and the duck curve resulting from higher renewables penetration and the oversupply from coal plants, with electricity storage seen both as a risk mitigator due to its intermittent electricity firming nature, and as a profit-enhancing tool.

The risk mitigation angle triggered an immediate series of opportunities for storage developers, with the AEMO tendering a System Integrity Protection Scheme (SIPS) contract in Victoria, EnergyCo tendering the Waratah Super Battery in New South Wales, and more recently AEMO tendering the Collie BESS in Western Australia, to name just a few. All these flagship projects are lithium batteries ranging from one to four-hour duration.

The positive side effect of these public sector initiatives has been to educate project financiers on Australian lithium-based BESS projects, not just as fully contracted type of assets, but also as projects that can capture arbitrage opportunities, and sell frequency control ancillary services products to the grid. The initial Battery Energy Storage System (BESS) projects were financed by the Clean Energy Finance Corporation (CEFC) almost exclusively, but from 2022 to 2023, more traditional commercial banks with project finance expertise have entered the BESS-financing market.

TABLE 1: PROJECT FINANCE DEALS