SMBC-JICA Sustainable Finance Framework

Overview

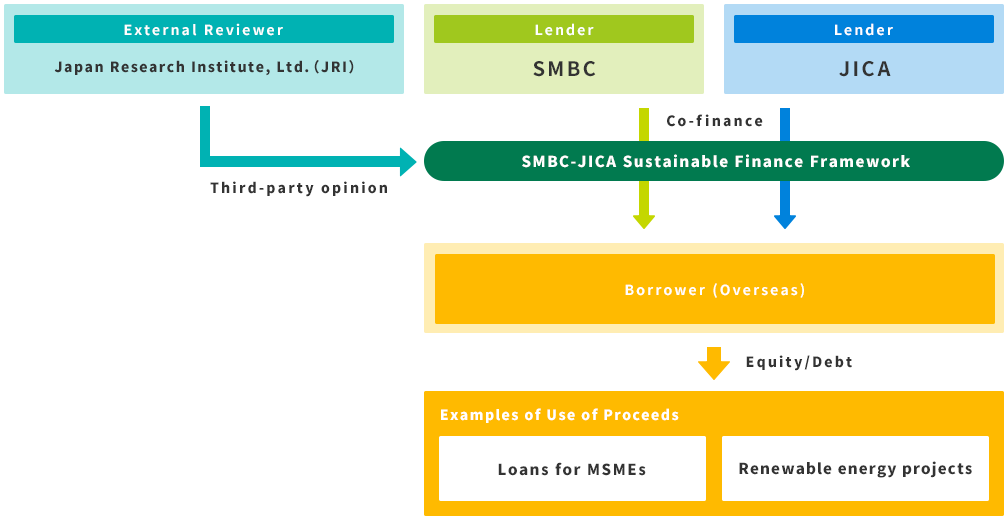

Loans extended under the SMBC-JICA Sustainable Finance Framework (hereinafter, "the Framework") are defined as those that contribute to the co-financing by Japan International Cooperation Agency (hereinafter, "JICA") and Sumitomo Mitsui Banking Corporation and its global affiliates (hereinafter, "SMBC"), and that improve certain environmental and/or social issues and that have a quantitative effect.

The Framework establishes the process of evaluation and selection for certifying eligible projects as Green/Social/Sustainable Loans, the use of whose proceeds are respectively limited to environmentally and/or socioeconomically conscious projects.

The Framework addresses the following four components set forth in the Guidelines and Principles (*1).

1. Use of Proceeds; 2. Process for Project Evaluation and Selection; 3. Management of Proceeds; and 4. Reporting

- (*1)Guidelines and Principles

Green Bond Principles, Social Bond Principles, and Sustainable Bond Guidelines published by the International Capital Market Association (hereinafter, "ICMA" (*2)).

Green Loan Principles, Sustainability Linked Loan Principles and Social Loan Principles published by the Loan Market Association (hereinafter, "LMA" (*3)). (In regard to loans based on the Sustainability Linked Loan Principles, the use of proceeds is required to be geared toward Sustainability Performance Targets (SPTs) linked to the loan's terms and conditions in order to measure the borrower’s sustainability performance.) - (*2)International Capital Market Association (ICMA)

The ICMA, established in 1968 and headquartered in Zurich, leads the establishment of the global standards in light of financial support for sustainable development and economic growth. - (*3)Loan Market Association (LMA)

Headquartered in London, the LMA was established in 1996 to promote the expansion of the loan market in Europe, the Middle East and Africa.

Structure

Summary of SMBC-JICA Sustainable Finance Framework

(1) Use of Proceeds

Loans extended under the Framework are co-financed by JICA (PSIF) and SMBC, as those that contribute to improving certain environmental and social issues, and that have a quantitative effect.

The target categories of JICA's PSIF are as follows:

- 1.accelerating infrastructure growth, and;

- 2.achievement of the SDGs (including poverty reduction and climate change measures)

From among the above categories, qualification shall be determined on an individual basis.

<Exclusion Criteria in the Framework>

- ・Projects whose use of proceeds is inconsistent with the policies set forth in SMBC's Credit policies and so forth.

- ・Projects in the sectors listed as non-qualified green projects within the SMBC Green Bond Framework.

- ・Loan policies have been formulated and published for projects and sectors that are likely to have a significant impact on the environment and society.

- ・If, as a result of a review by SMBC, it is determined that a proposed loan project falls under the exclusion criteria, the project will be excluded from the applicable projects of the Framework and will be continuously reviewed.

(2) Process for Project Evaluation and Selection

- ●Summary of Eligibility Criteria

SMBC will examine the following points: -

- ①Details of the target project

- ②Consistency with social and environmental issues

- ③Evaluation of social impact

- ④Management of proceeds

- ⑤Disclosure of the impact

JICA's loan aid operations (including PSIF) are implemented through a screening and selection process involving the Japanese government and external experts.

Individual projects are evaluated and selected to ensure compatibility with JICA Law, the Development Cooperation Charter, and the relevant developing countries’ economic and social development plans. The project plans are examined based on six criteria set by DAC (Development Assistance Committee) in OECD (Organization for Economic Co-operation and Development).

- ●Financing Process

The outline of the process by SMBC up to the loan disbursement is as follows: -

- ①Prepare and verify a check sheet for each relevant SMBC department to confirm that the use of the proceeds meets the eligibility criteria;

- ②Determine that the use of the funds meets the eligibility criteria;

- ③If it is determined that the selection criteria and eligibility have not been met, the lenders shall consult with the borrower, make modifications, and return to ① to ensure that the loans concerned are consistent with the Framework, and;

- ④In addition to verifying the eligibility of the business, the department in charge of screening shall evaluate the credit conditions and so forth and decides on the loan.

- ●Environmental and Social Considerations in Business Activities, Guidelines, etc.

Guidelines and principles to be referred to for the Project Selection are as follows: -

- ・SMBC Credit Policy

- ・Environmental and social risk assessment and monitoring based on SMBC’s “the Procedures for Environmental and Social Risk Assessment"

- ・Business and sector policies that are likely to have a major impact on the environment and society

- ・JICA Guidelines for Environmental and Social Considerations

- ・JICA Anti-Corruption Guidance

(3) Management of Proceeds

- ●Method for Tracking and Managing Proceeds

SMBC receives reports from the borrower when the loans are used for eligible projects or on an annual basis.

The relevant departments shall annually report the status of fund allocation management to SMBC.

(4) Reporting

- ●Setting up a KPI

The KPI (output basis) will be set by JICA and SMBC in consultation on the results of projects to which funds have been allocated. - ●Disclosure Method, Frequency, and Management Method for Impact Reporting

The borrower shall annually report on the status of the appropriation of proceeds. The content will be verified by SMBC. - ● Internal Audits and External Reviews

JICA conducts ex-ante and ex-post evaluations of all loan aid operations (projects for which the amount of cooperation is 200 million yen or more) based on the six criteria set by DAC used for international ODA evaluation.

External reviews shall be conducted annually to confirm the consistency of the Framework and the status of individual businesses.

The results of the review shall be made public.

However, external review is unnecessary when there is little or no change to the impact of the individual project.

Evaluation result

This Framework has been reviewed by Japan Research Institute, Ltd. and is found to be consistent with the Guidelines and Principles.

<(PDF) Third-Party Opinion result from the external reviewer (JRI)>

Disclaimer

- 1.Please note that SMBC requests that Borrower, who entered into the loan agreement under the Framework, execute the items below;

-

- A)to prepare a loan agreement that follows the Framework under consultation with JICA and SMBC by the disbursement date; and

- B)to annually submit an Impact Report during the period after the disbursement until the final repayment.

- 2.Others

-

- -JICA and SMBC respectively conduct credit due diligence for financing from each party.

- -Prior to entering into any agreement, please make sure to fully understand the content of this product and judge by your own decision.

- -Please consult with relevant professional advisors, such as certified tax accountants, certified public accountants and legal counsel regarding the terms and conditions thereof, the tax, accounting and legal implications and consequences thereof, and the risks associated therewith.

We provide no guarantee as to the accuracy of the advice of such professionals and we do not provide any such advice. - -We provide services under the assumption that you are acting on your own free and independent judgment.

We do not make it a condition that you accept and participate in this structure for us to continue any loan or other transactions with you, nor will you receive any disadvantageous treatment on the grounds that you do not accept the structure. - -For more information, please contact the SMBC office in your region.